TECH DIVE: Will LEDs become the Tesla of the UV sector?

Light-emitting diode (LED) technology has been promising to disrupt the traditional ultraviolet (UV) lamp disinfection market for years. Will 2019 finally be the year when UV-LED can be proved at scale? This article investigates UV light for water purification.

Twitter outbursts and smoking drugs live on radio to one side, few can doubt the disruption caused by serial entrepreneur Elon Musk.

From the finance industry and PayPal, through to interplanetary travel and Space-X and underground tunnelling and The Boring Company; Musk has disrupted multiple industries and even has his sights set on inhabiting the planet Mars.

Yet, it is the disruption caused to the fossil fuel car industry by electric vehicle brand, Tesla, which some believe could play out in the water treatment market and ultraviolet treatment (UV) space.

“Existing companies already in the UV market have to decide whether they’re going to add LED technology to their portfolio,” says Oliver Lawal, president of the International Ultraviolet Association (IUVA).

“I always think of it a bit like cars - companies have petrol and diesel, and then do you add electric? Much like the automotive industry, some of the existing manufacturers will have their own development programme and some of them are going to partner. This is already happening.”

UV light for water treatment and water purification

Tipping point

Haitz law predicts that LEDs will halve in cost and double in light output every two years

LED technology may have caused disruption to the traditional light market but the impact on large scale, municipal ultraviolet (UV) treatment has always been passed off as being “years away”.

Historically UV-LED systems have been limited to low flow, or personal use water treatment products on the market. In contrast, mercury lamp UV technology has been the go-to, dominant force for utility scale treatment systems.

However, Lawal who is also the CEO of AquiSense, believes LED technology became cost competitive last year.

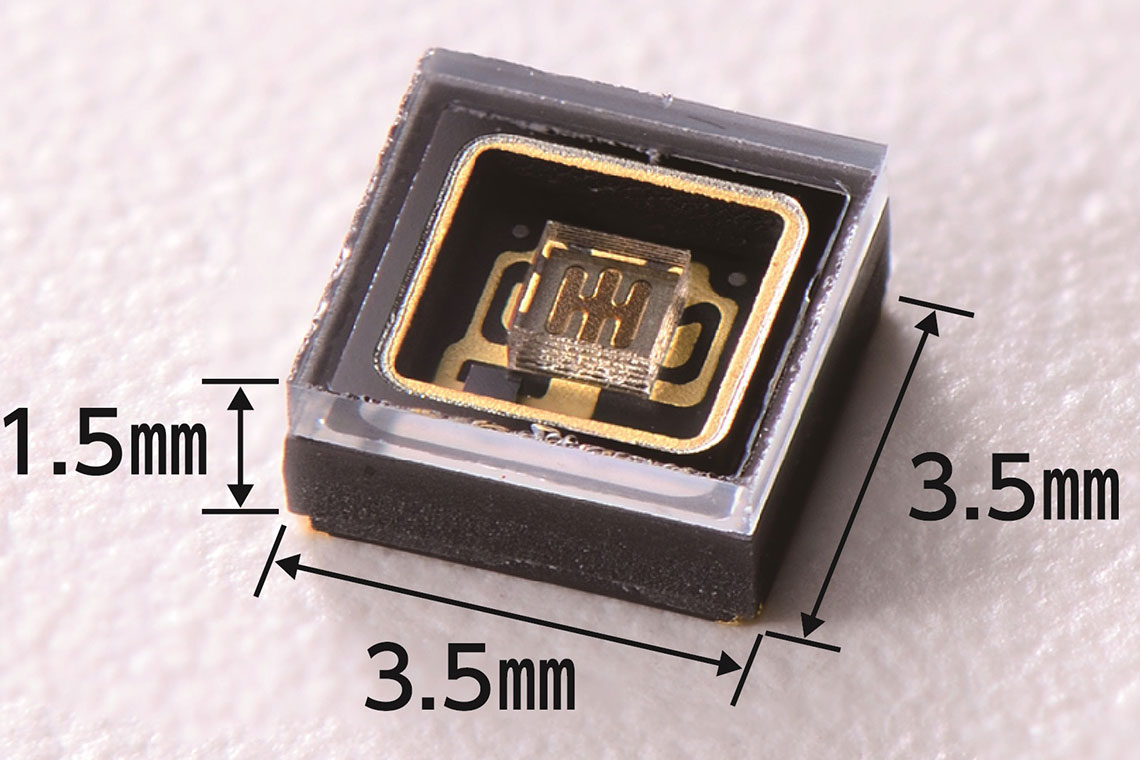

“In 2018 we had a tipping point, so that best-on-class UV-LEDs now have a higher power density than Low Pressure Mercury Lamps and our high-volume LED purchase price is now equivalent to some traditional lamps in terms of cost/photon, and that is really important. We knew that would happen,” he adds.

Japanese innovation

Metawater has manufactured a 300 m3/day and a 1200 m3/day scale UV-LED units

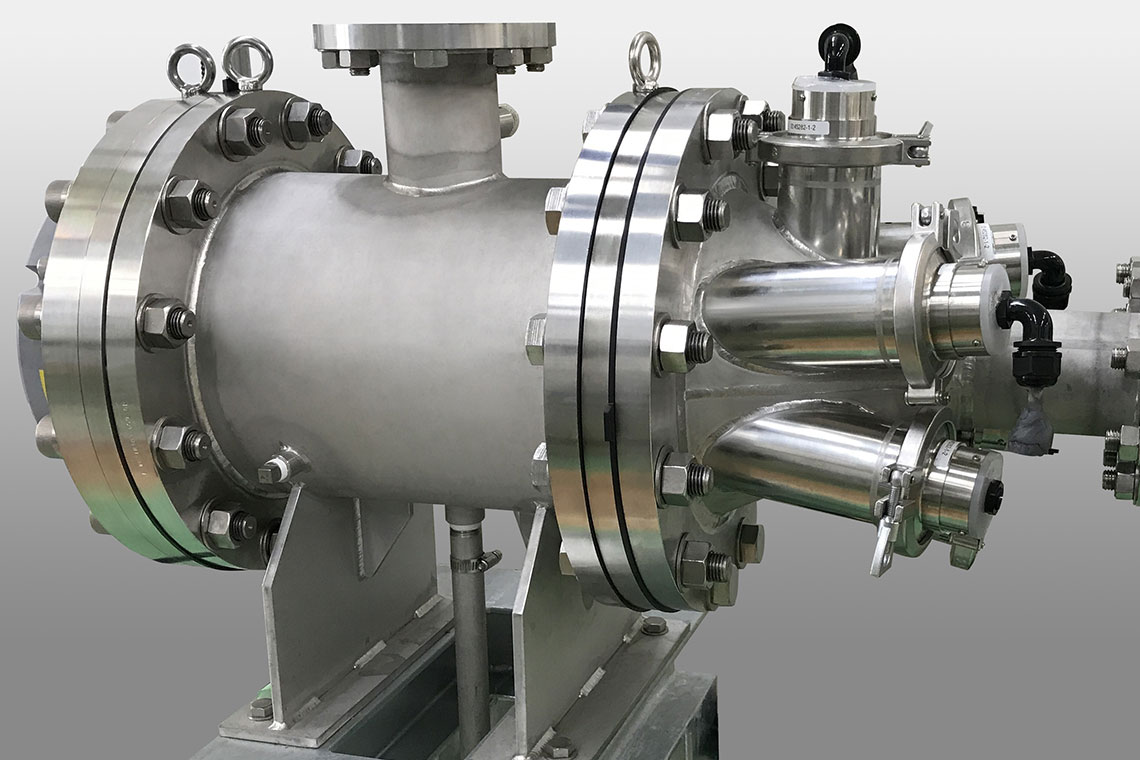

One of the companies spearheading the scaling up of LED technology is Japanese technology company, Metawater, perhaps better known for its ceramic membrane technology.

The company started with a 300 m3/day UV-LED system before jumping up to a 1,200 m3/day scale system. For the latter it recently acquired the “Certification of UV irradiation equipment” from the Japan Water Research Center (JWRC).

Furthermore, an agreement has been signed with water treatment technology manufacturer, Risui-Kagaku Co, for the “OEM supply of UV treatment equipment using UV-LED”.

Metawater is aiming to have the larger scale system in treatment facilities serving 100,000 people but says it is still working on reducing the cost of UV reactors and LED modules. This includes improving LED optical power and “achieving longer life”.

Creating a LED Typhon

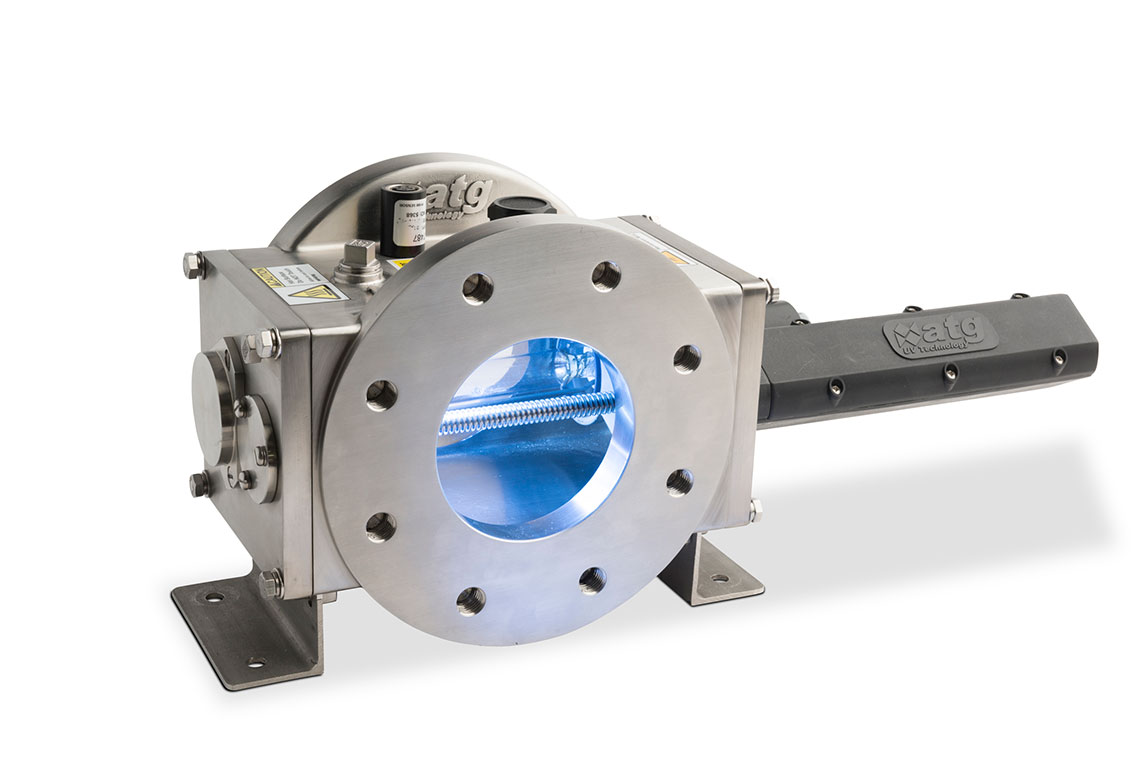

Another company worth noting, this time in the UK, is start-up Typhon Treatment Systems, which has signed an eight-year, kit framework agreement with UK water company, United Utilities (UU).

This followed two trials, one on advanced oxidation process (AOP) for the removal on taste and odour and a second on disinfection, which has led to the company achieving validation in line with the UVDGM methodology from the US Environmental Protection Agency (EPA).

Typhon’s base unit has a capacity of 250 m3/hour (6000 m3/day) with a configuration allowing multiple systems can be combined to scale up. For the first large scale commercial installation, currently being negotiated with UU, a total of six units will be installed.

When operational, at a capacity of 36,000 m3/day, this would make it the world’s largest, municipal scale UV-LED installation, according to company co-founder Dr Matthew Simpson. The contract is slated to be finalised by mid-2019.

The company was co-founded with Peter McNulty in 2014 and sets out the bold claim that its UV-LED design uses “up to 90 percent less energy compared to mercury lamp technology”.

United Utilities plans to use system to treat for microorganisms or help remove taste and odour from drinking water and also, in separate installations, to treat bacteria in wastewater before returning it to the environment.

In the video below you can see the trial installation: