Supply chain woes and sludge disposal loads push P recovery in Europe

Concerns around securing a future supply of phosphorus (P), mainly for the production of food, is beginning to accelerate the development and uptake of technologies that can obtain the material from wastewater and sewage sludge. Technologies that recover P from sewage sludge ash are currently the biggest growth market.

How have the drivers changed?

Phosphorus is an essential nutrient for food production, as well as a core precursor to many materials such as animal feed and chemical products. The element is usually sourced from rock deposits, which are isolated to only a few geographies, and are a non-renewable source. The consensus for recovering phosphorus from wastes is a growing trend, with sewage being identified a viable feedstock.

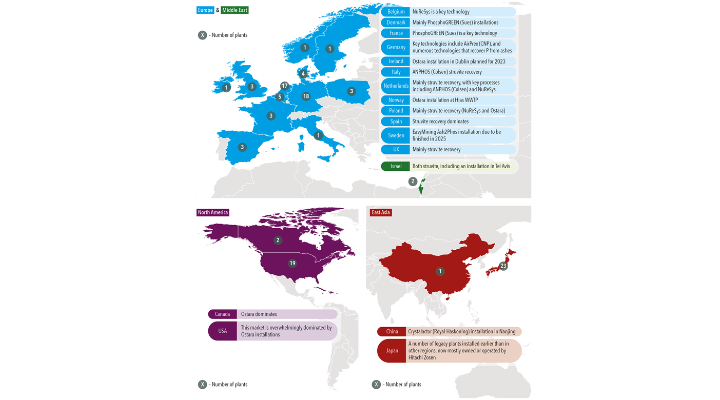

Although there are projects for phosphorus recovery from sewage on a global scale, Europe is currently the biggest growth area as the region imports all of its phosphate rock and derived materials, and is also implementing regulations affecting sludge disposal and land spreading.

Many European countries previously depended on Russia for a large proportion of their phosphorus supply, and exports out of China have been squeezed to all geographies over the last few years. Although fertiliser prices in 2023 have eased from the recent peak in 2022, prices are still higher than the historical average.

“Other drivers that are felt on a global scale include the continued concern surrounding the presence of heavy metals and micropollutants in sewage sludge.”

In 2022, the EU’s Fertilising Products Regulations were updated to declare end-of-waste status for recycled fertilisers and create a harmonised single market as part of its Circular Economy Package – a series of wide-reaching initiatives for the region that include the revision of waste legislation and sustainable building guidelines.

Switzerland introduced a regulation for phosphorus recovery from sewage sludge in 2016, becoming the first country in the world to do so. Germany is also a frontrunner for P recovery, having laid national regulations by revising its Sewage Sludge Ordinance to stipulate phosphorus recovery from larger wastewater treatment plants, with deadlines of 2029 or 2032 depending on the plant size. In 2022, Austria put forward its plans for a regulation stipulating sludge incineration and P recovery, to come into force before 2030.

Other drivers that are felt on a global scale include the continued concern surrounding the presence of heavy metals and micropollutants in sewage sludge that is usually spread on land. A number of phosphorus recovery technologies are able to somewhat mitigate the presence of these pollutants, and the spreading of recycled fertilisers derived from sewage sludge can often be the “cleaner” option compared to directly spreading biosolids.

Furthermore, the increased amount of urban sprawl both increasing the amount of sludge and reducing suitable disposal routes. As a result, incineration is likely to grow in popularity due to its superior ability to reduce volumes, opening up the opportunity to use more technologies that recover phosphorus from sewage sludge ashes.

How is phosphorus recovered?

There are two key types of phosphorus recovery from wastewater and sludge: recovery from the liquid phase (often in the form of struvite) and recovery from the incinerated ashes of sewage sludge. The former was first developed in the 1990s when many treatment plants switched to biological nutrient removal from chemical methods as part of the secondary treatment step, which caused the involuntary side effect of struvite precipitation in downstream sludge handling processes. This caused operational issues for treatment plants, resulting in the development of technologies to assist.

Key players in the space now include Ostara, Colsen, and Veolia Water Technologies. Many of these solutions divert the precipitation of struvite to a different part of the system and have the secondary benefit of making it harvestable. These technologies enjoyed early dominance in the market and continue to be the most mature for now, with systems installed in a number of global geographies.

However, technologies that obtain phosphorus from sewage sludge incineration ash are also beginning to enter the limelight. These technologies range in their methods, but the most common is the dissolution of the phosphorus from the ash using an acid. Purification methods may be used afterwards to remove heavy metals.

The presence of impurities in recycled phosphorus fertilisers is one of the key obstacles that technology companies are attempting to overcome in the current market, as such products often do not match the quality of raw material-derived counterparts. Ash-based recovery technologies have enjoyed a more recent uptick, with most of the planned and running installations focused on Europe, where sewage sludge incineration is becoming more commonplace.

Using a previously untappable resource

It is expected that the proliferation of struvite-recovery installations that take phosphorus from the liquid phase will follow the market for biological phosphorus removal, which is a particularly popular nutrient removal method in Europe, North America, and South Africa.

In these cases, the P is relatively easy to recover from the biomass. However there are other widely used, chemically-driven methods of removing P from wastewater. These methods produce a generally non-recyclable by-product where the phosphorus is strongly bound to iron or aluminium, making recovery a harder job.

However, a consortium of participants in Europe are attempting to challenge this idea, including Wetsus, TU Delft, STOWA, Kemira, Metso Outotec, and a number of European utilities. The ViviMag technology, for which Kemira holds the intellectual property, looks to exploit the magnetic properties of vivianite – a form of iron and phosphate bound together – to remove the compound from the sludge for beneficial use.

Kemira finalised its first full-scale trial for the technology in February 2023, which was carried out in collaboration with Veolia at a treatment plant in Schönebeck, Germany.

The group of participants is now looking to build a market for the harvested product, either as-is or after separation of the iron. Although iron is generally considered as an impurity in recovered fertilisers, a number of European countries such as Spain or Italy could benefit from enriching deficient soils with the metal. Going forward, the consortium is also looking into cost-efficient ways to separate the strong iron-phosphorus bond, in order to further widen the offtake markets.

Bucking the trend

Looking into the future, there are some projects looking to make P recovery technologies even more sustainable, as well as attempting to create phosphorus compounds with applications outside of fertilisers.

Of particular note is the FlashPhos project, which is looking to recover phosphorus in its P4 form – a key precursor to most of the phosphorus products on the market. The project is being coordinated by the University of Stuttgart and has a large consortium of participants. The process itself first dries the sewage sludge to up to 95% solids, then uses flash gasification at high temperatures to remove heavy metals and organics. Finally, the slag that is produced is introduced to a furnace to reduce the phosphates to P4.

One of the limitations of the more commonplace method of acid leaching phosphorus from sludge ash is that disposal issues remain with extra residual material, unless it can be converted using an economical process to other useful materials.

The team at FlashPhos is looking to change this by using all waste streams. For example, one aim is to produce an environmentally-friendly cement additive with its residues. Although other P-recovery processes generally don’t apply high temperatures after the incineration step like FlashPhos, the team believes that its technology can reduce the fossil fuel energy consumption of cement production, which is one of the world’s most CO2-emitting industries.

Source: GWI; C. Kabbe

Source: GWI; C. Kabbe

This article has been produced by our knowledge partner, GWI.

We promise never to send you spam and you can unsubscribe at any time!