Closing the Loop: Water and the Circular Economy

This year, GWI explored several opportunities and developments that are allowing the water sector to shift towards a circular economy, in our knowledge partnership articles with Aquatech. This has highlighted the potential to reduce water withdrawal needs, increase process efficiency, recover valuable resources, and limit harmful greenhouse gas emissions.

In the final piece in this series, we take a broader look at what a circular economy could look like for the water sector. Our Circular Economy Pavilion at this year’s Aquatech Amsterdam exhibition will then take a deeper dive into the biggest opportunities for the sector – an event that is not to be missed!

Water reuse practices around the world

With water stress growing across the world, limiting the need for withdrawals and increasing efficiency of water use is becoming more necessary to keep within sustainable consumption levels. Wastewater reuse can be central to achieving this.

The level of wastewater reuse acceptance, both in the eyes of the public and the law, varies greatly across the world. In Namibia, for example, direct potable reuse (DPR) has been carried out since the 1990s – a practice that was also introduced to the Philippines by Maynilad Water Services in 2022. DPR involves treating wastewater to directly add to drinking water supplies, usually through a multi-barrier approach involving a combination of ozonation, ultrafiltration, reverse osmosis, and disinfection to meet high quality standards.

DPR remains uncommon globally, but some legislative shifts in water-stressed areas are making it a potential avenue to explore in the future – such as in the US states of Texas, Arizona, Colorado and California. For example, California’s draft regulation to allow DPR, expected to be adopted 31 December 2023, has already led to the world’s largest DPR project being planned: the 60 million gallon per day of DPR at Pure Water Southern California, expected to be live in 2032.

More commonly considered is indirect potable reuse (IPR) – such as managed aquifer recharge, covered by GWI in a previous Aquatech article – or non-potable reuse. Non-potable reuse includes reuse for irrigation in agriculture, thereby reducing freshwater demand from the application, which accounts for around 70 per cent of total water use globally. The implementation of minimum standards for agricultural reuse across the EU this year represents a meaningful step in this direction.

However, industrial reuse is most widespread thus far. This is driven by desires to increase production capacity without placing further strain on water resources, especially in water stressed regions where local legislation puts pressure on water intensive industries to reduce water withdrawals and consumption volumes. In the mining industry, for example, Anglo American implemented a closed loop recycling system and advanced evaporation measurement technology to achieve rates of 82 per cent water reuse in 2022 across all sites.

Leading companies in the personal care sector have also successfully implemented industrial water reuse and efficiency improvements in their production: Procter & Gamble, for example, recycles around three billion litres of water each year. L’Oreal, meanwhile, aims to have 100 per cent of the water used in its industrial processes recycled and reused in a loop by 2030.

Resource recovery to limit waste

Another key principle of a circular economy is reducing the need for virgin resources – a step that can be supported by recovering materials from wastewater and sludge. This also presents an additional revenue stream for wastewater treatment plants recovering valuable resources.

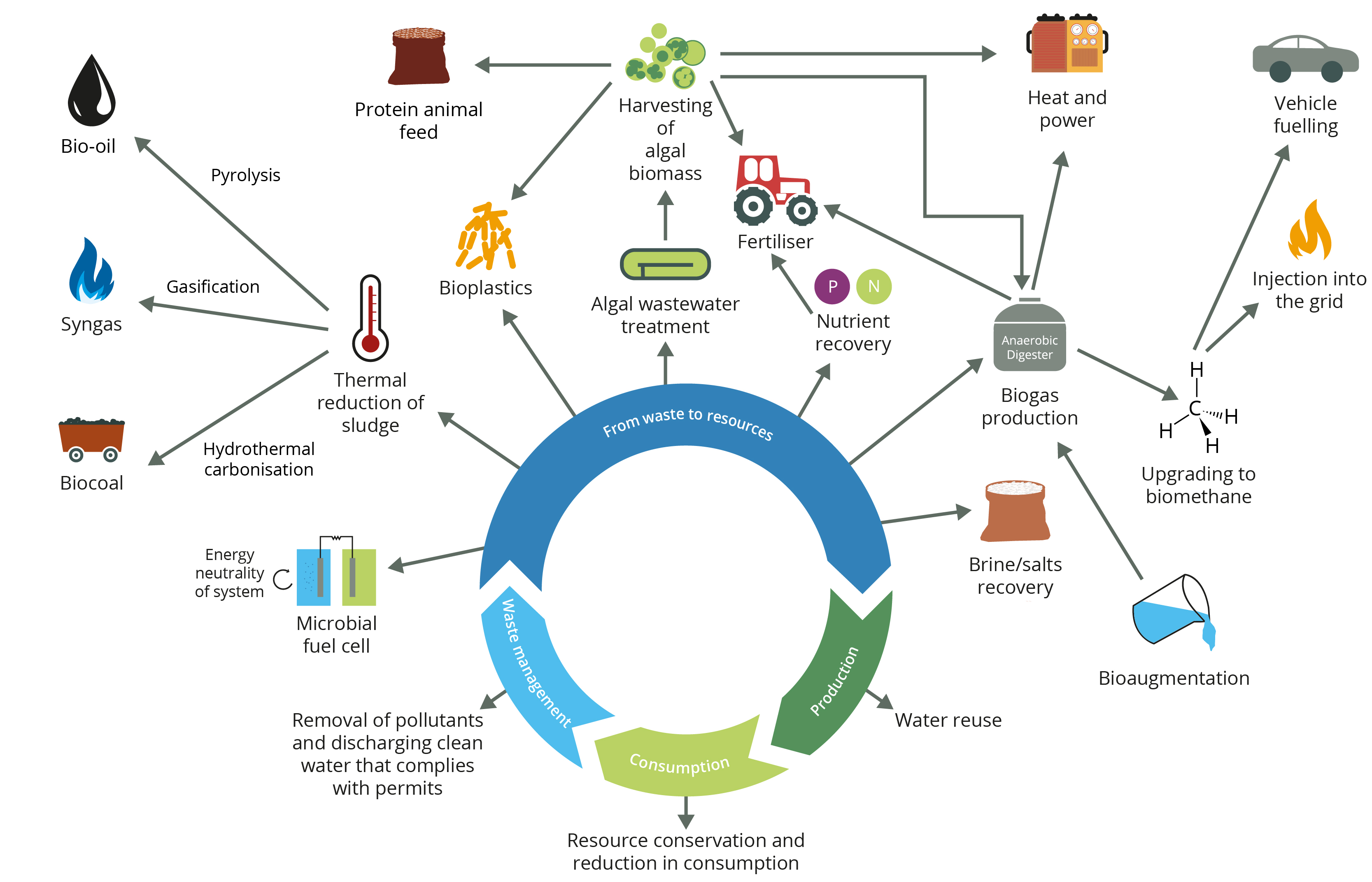

As illustrated by the graphic (below), there is an enormous range of resources to be recovered from wastewater and sludge: from energy sources like biogas or biomethane, to phosphorus and nitrogen recovery for recycled fertilisers, all the way to rare earth elements like lithium or gold. The water industry is making significant strides towards making recovery of these materials more financially viable.

[Source: GWI]

An exciting technology that is being touted for its resource recovery potential is nanofiltration. Utilising these membranes in wastewater treatment has successfully enabled the recovery of caustic soda and indigo dye – key resources for industrial cleaning and textile manufacturing, respectively. Likewise, nanofiltration on a variety of brines can recover lithium, which is in high demand for battery manufacturing. Key players in the nanofiltration market that are recovering these resources include NX filtration and Koch Separation Solutions (KSS). For more details on this market, see the related content below.

Efficiency gains for resources and energy use

While more capital-intensive options for resource recovery and water reuse are an exciting proposition for a more circular water sector, cutting out inefficiency and maximising the usefulness of resources in treatment processes are often overlooked and are a more accessible option. In this space, many companies are working on products and processes to make treatment more energy and resource efficient.

Danfoss, for example, has incorporated the refurbishment of used products and parts into its business model, thus extending their products’ useful life and reducing metal waste. Similar efforts to extend the longevity of equipment can be seen in the work of Lygos, which is reducing corrosion wear to cooling towers with its novel green corrosion inhibitor, Soltellus.

To address both the carbon emissions associated with higher energy use and rising costs, increasing energy efficiency is another lively innovation area. This is especially relevant for desalination processes, which are notoriously energy intensive; Danfoss’s energy-efficient high-power pumps have enabled seawater reverse osmosis systems to reduce GHG emissions and total costs by 15-20 per cent. Endress + Hauser also specialises in process optimisation through automation in both municipal and industrial settings – enabling increased efficiency.

Other companies are attempting to carve out a niche when it comes to sustainability consulting, helping guide projects through the complex landscape of potential circular water solutions. This includes Nuoro, a Belgian start-up founded in 2022, which seeks to address a range of water challenges with mobile and containerised systems. Nuoro, along with the rest of the companies mentioned in this section, will be involved in the Circular Economy Pavilion at Aquatech Amsterdam.

Greenhouse gas emission reduction

While climate change is expected to require significant adaptation measures from the water sector, it can also make a substantial contribution to mitigation efforts. GWI explored this topic in detail in its “Water Without Carbon” whitepaper, finding that approximately 1.8 per cent of global carbon emissions come from the water sector. This also highlighted the importance of addressing energy use from fossil fuels as this generates an estimated 52 per cent of water infrastructure’s emissions.

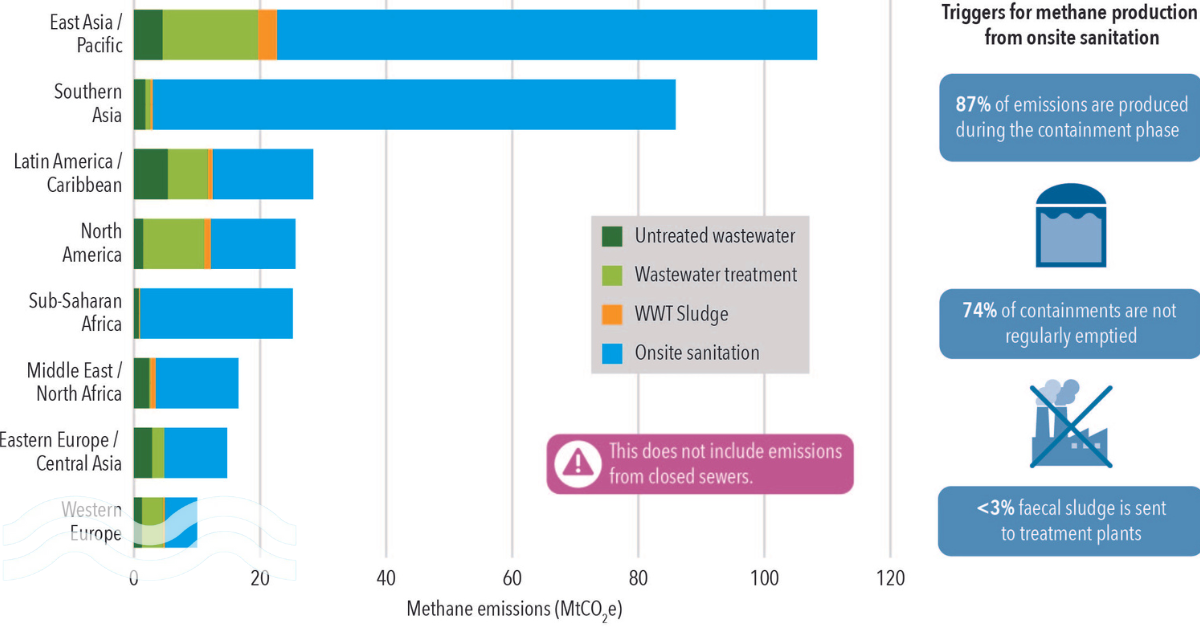

Along with adjusting energy use, the water sector’s direct greenhouse gas emissions present a significant opportunity for mitigation. Methane emissions from wastewater, accounting for 37 per cent of water infrastructure’s emissions, are an urgent issue to address. The biggest contributor to this problem is emissions from onsite sanitation (OSS) – a practice which approximately 50 per cent of the world's population relies on.

Many OSS systems are mismanaged, with faecal sludge often not being emptied regularly, allowing emissions to increase. When they are emptied, less than 3 per cent is treated. While technological developments to improve OSS are actively being explored, existing cost-effective alternatives such as container-based sanitation are readily available, if financing can be secured. These are emptied weekly – as opposed to the average septic tank which is emptied after eight years – resulting in a significant reduction of methane emissions.

[Source: GWI]

Centralised wastewater and sludge treatment sites are also ideal locations for emission mitigation. Practices such as preventing methane leaks from anaerobic digestion are the low-hanging fruit. Technologies are also emerging to reduce, capture and utilise emissions as another valuable by-product of wastewater treatment.

The Aquatech Amsterdam Circular Economy Pavilion will act as a platform for stakeholders to explore best practices and innovations that improve the sustainability of the water sector. We hope to see many of you there.