ESG reporting and water strategy: Navigating challenges and change

Environmental, Social and Governance (ESG) investments and reporting frameworks have gained significant traction in recent years as a means to promote sustainable and responsible business practices. However, they are not without their challenges and criticisms.

The challenges of ESG frameworks

While powerful tools for fostering sustainable practices, ESG frameworks face scrutiny due to a whole host of challenges such as the lack of standardised metrics, potential greenwashing, data accuracy issues, subjective evaluation, limited regulatory oversight, resource burdens for implementation and concerns about their transformative impact to name just a few.

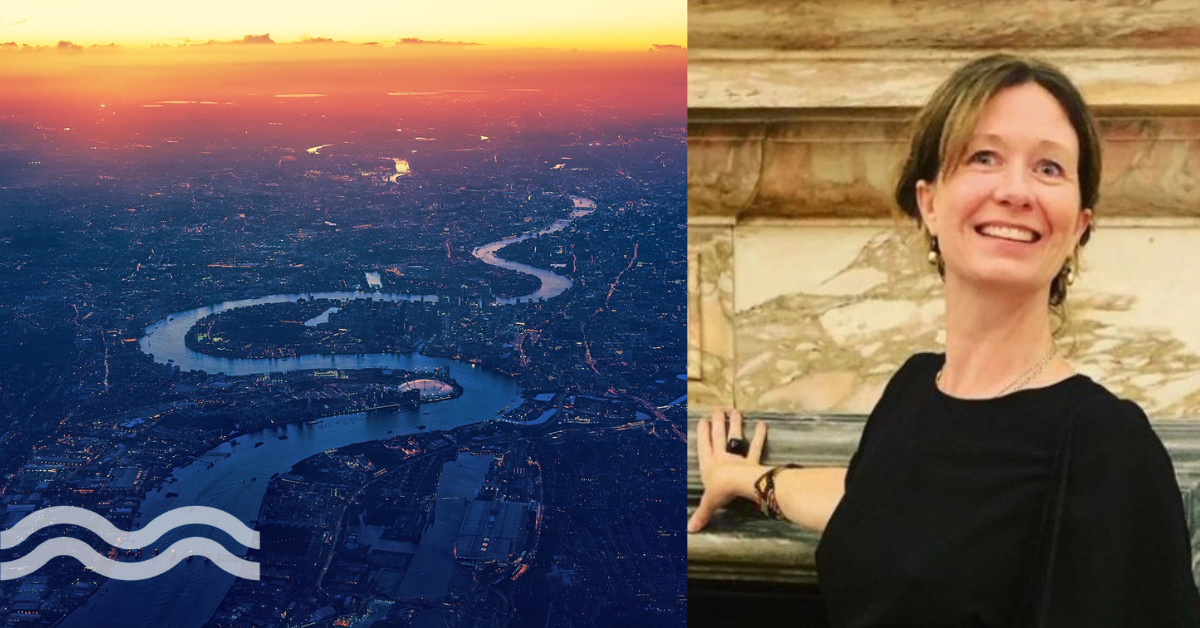

Speaking to Aquatech Online, independent global sustainability advisor, Illana Adamson, says: “One of the greatest choke points is the knowledge gap around sustainability. We have seen a recent realisation of the risk associated with ‘competence-greenwashing’, a greenwashing of skills or expertise where sustainability or ESG is added to senior titles who do not have the necessary knowledge or experience.

“This practice, coupled with the tension between short term profit and long term strategy, results in a lack of resilience for the organisation and, more importantly, it results in the continued breaching of planetary boundaries.”

EU regulation around sustainability is also rapidly changing, creating significant complexity across sectors.

In 2024 European firms with more than 500 employees must collect ESG data on every single company up and down their supply chains. In 2025, the rules expand to include companies with a minimum of 250 staff.

Water’s role in sustainable development

Water strategy and commitments have gained significant importance in ESG reporting, driven by the acknowledgment of water's role in sustainable development, environmental responsibility, and societal wellbeing. Companies' water management practices, adherence to regulations, and engagement with stakeholders are pivotal aspects of ESG reporting. Efficient water use enhances operational efficiency and resilience, while innovative water conservation technologies foster adaptability.

Prioritising water stewardship strengthens community relations and reputation. ESG-conscious investors value companies with robust water strategies, as they align with sustainability goals and attract responsible investment. Transparency through ESG reporting showcases a company's water-related efforts and contributions to global objectives, emphasizing their commitment to a sustainable future.

Adamson adds: “The big question each firm needs to ask themselves when it comes to ESG reporting is ‘what are we trying to achieve?’ A good ESG score or a better environmental outcome? There is often little correlation between the two, whereby firms can achieve high ESG ratings, yet pollute or overconsume as much as low rating organisations. In sustainability there is always a trade-off so if water strategy is the priority, the trade off may be a lower ESG score. To my mind aligning to planetary boundaries should always be the aim, but ticking boxes often satisfies short term fiduciary priorities.”

Corporate ESG developments

As concerns about water scarcity, quality, and environmental impact grow, more companies are recognising the importance of sustainable water management and are making efforts to address water-related challenges in their ESG initiatives.

The specific details and focus of these strategies can vary based on the industry, geographic location, and the company's unique circumstances. Some well-known corporations that emphasize water strategy in their ESG reporting include Nestle, Coca-Cola and Unilever.

Nestlé has committed to water neutrality and sustainable water management – the company’s ESG reporting highlights its efforts to improve water efficiency, address water scarcity risks, and support local communities' access to clean water.

The Coca-Cola Company is known for its comprehensive approach to water stewardship. It sets water efficiency targets, engages in watershed protection initiatives, and invests in water conservation projects.

Unilever’s water management efforts

Meanwhile, Unilever, a multinational consumer goods company, emphasizes water management and conservation in its ESG reporting. The company has set ambitious goals to reduce water consumption in its operations and supply chain while also addressing water-related social issues through community engagement.

In the automotive industry, Ford Motor Company has been vocal about its water conservation efforts. The company's ESG reporting highlights its commitment to reducing water usage in manufacturing processes and its efforts to manage water-related risks across its value chain.

Another example is global mining and resources company, BHP, which focuses on water stewardship in its ESG reporting. The company discloses its efforts to manage water-related impacts associated with its operations and mining activities.

Technology company Intel emphasizes water conservation and sustainable water use in its ESG reporting. The company's initiatives include water reduction goals, water risk assessment, and investment in water-saving technologies.

These are just a few examples, and many other large corporations across various industries integrate water strategy into their ESG reporting.

Does water play a big enough part in ESG reporting?

There is a strong argument for water to play a bigger role in ESG reporting. Incorporating water as a significant component of ESG reporting not only helps companies assess their environmental and social impacts more comprehensively but also ensures that investors, stakeholders, and the public have a clearer understanding of a company's efforts to manage water resources responsibly.

As water-related challenges continue to intensify, a more prominent role for water in ESG reporting can contribute to more informed decision-making and foster positive change.

When asked if water is playing a big enough role in ESG frameworks, Adamson believes that increasing sustainability reporting demands will pull into sharp focus the dependency of many organisations on the natural resources that have previously been considered ‘external’ to business concerns.

“For some organisations water management is already a key feature in sustainability efforts, this is often voluntary and driven by financial risk rather than environmental ambitions,” she says.

“In the upcoming years biodiversity and water will feature much more prominently in ESG and these disclosure demands will now be mandatory,” she concludes.

We promise never to send you spam and you can unsubscribe at any time!