Knowledge partner GWI

Knowledge partner GWI

Co-digestion of solid waste and sewage sludge can significantly increase biogas yields to a scale that allows for economically viable capture and utilisation – providing a sustainable route for carbon footprint reduction while also addressing organic waste disposal problems. GWI discusses the opportunity that this practice may offer to support net zero ambitions.

Organic waste disposal presents a huge hurdle for countries seeking to reduce landfill use, but excess capacity in wastewater treatment plants’ anaerobic digestors could turn this into an opportunity for renewable power generation.

Through the digestion of sewage sludge, many wastewater treatment plants have begun producing biogas that can be used onsite to generate renewable energy, decreasing their carbon footprint. To increase the yield of biogas, co-digestion of solid organic waste with sludge has been implemented in leading wastewater treatment facilities globally.

Biogas generation, capture and utilisation can play a significant role in reducing both direct greenhouse gas (GHG) emissions (scope 1) and indirect emissions arising from energy use (scope 2) during wastewater treatment. Capturing methane, which is released from sludge as biogas during digestion, can minimise direct methane emissions – helping to address the 6.4 million carbon dioxide-equivalent tonnes of methane that GWI estimates is produced from global sludge management each year.

By utilising combined heat and power (CHP) systems, this captured biogas can provide energy in the form of both heat and electricity for use onsite, thus minimising scope 2 emissions as well. When biogas yields are high enough, utilities can further capitalise on this resource by exporting to national electric or gas grids. Meeting emission reduction targets and reaching these profitable yields of biogas is therefore driving a growing appetite for co-digestion.

Co-digestion works by treating multiple feedstocks simultaneously in an anaerobic digester. This could involve a range of different feedstocks – food waste, sewage sludge, purpose-grown energy crops, agricultural waste or manure, and more. The opportunity for wastewater facilities to take on this extra feedstock is particularly strong as many such facilities have been over-engineered to include excess, unused digester capacity.

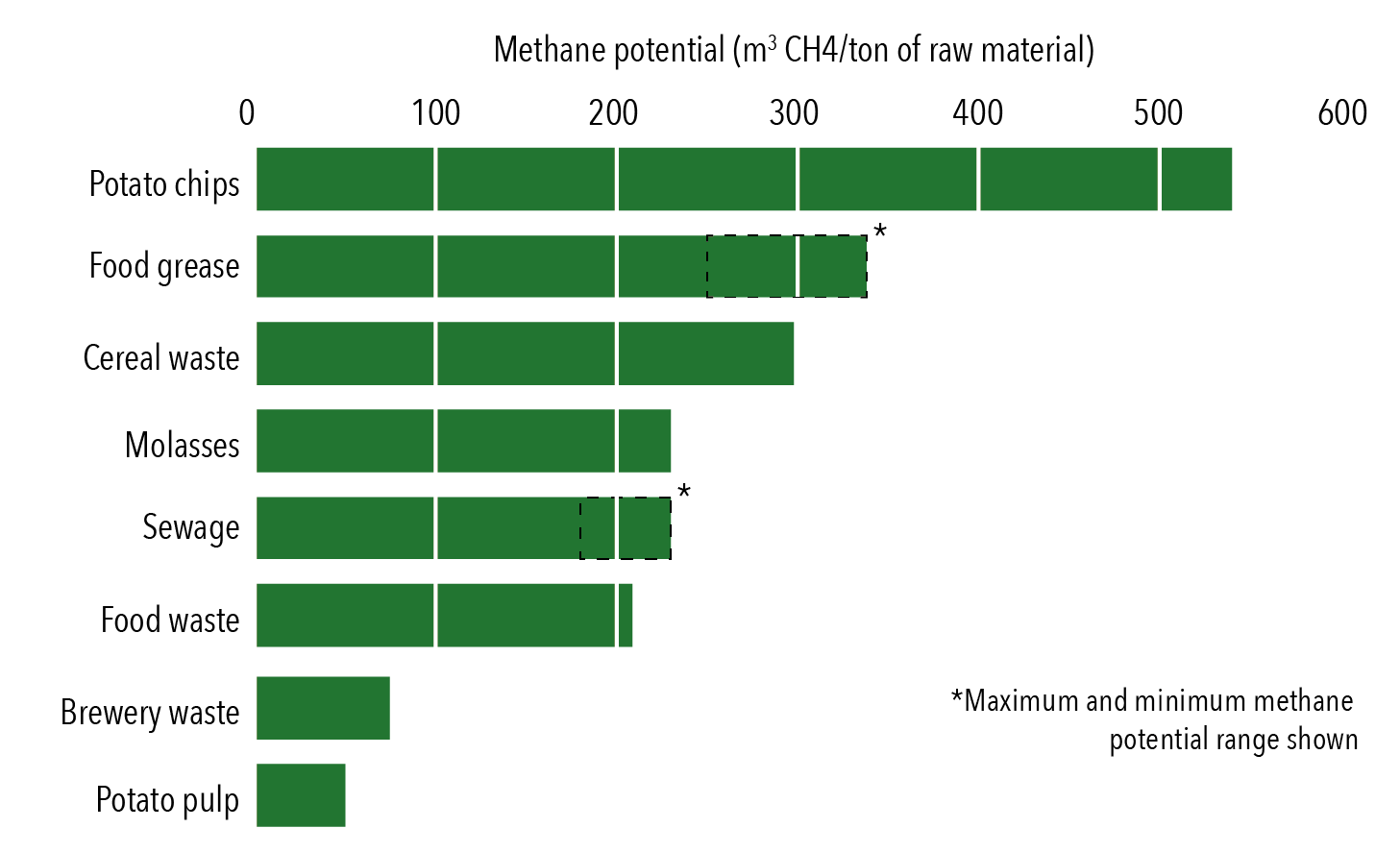

Additionally, organic waste is typically lighter and easier to transport than high-water content sludge. Food waste, both from industry and households, is most frequently used to supplement sludge as it is abundantly available; by-products from factories, such as waste brewery grain, are also common feedstocks for co-digestion. The graphic below compares the methane potential of a range of different feedstocks, though notably choices are typically made based on availability and proximity to the treatment plant.

Source: GWI

One concern that limits the uptake of co-digestion with household food waste is the potential for contamination due to its highly variable quality and diverse contents. This concern is particularly strong with respect to plastics, as utilities attempt to minimise the microplastic content of sludge prior to disposal. Avoiding the addition of a feedstock that may worsen this problem is seen as more pertinent for some than biogas yield improvement – especially if the implementation of more stringent pre-treatment would negate any economic benefits. While utilising other feedstocks which offer more predictable, homogenous contents may avoid this concern, the higher desirability of these feedstocks tends to reduce their availability.

Many of these logistical concerns over feedstock availability and quality can be addressed when partnerships between utilities and organic waste suppliers are formed. While this process can add an additional workload that puts many small utilities off co-digestion, an effective partnership between a wastewater treatment facility and either a private food-processing business or the municipal department running domestic food waste collection can see successful benefits.

Small- to medium-sized businesses can be particularly suitable, as those producing one kind of product will have more homogenous food waste than large businesses or domestic sources. For example, a 2022 trial at Scottish Water’s Nigg Wastewater Treatment Works in Aberdeen saw the utility take on brewery and distillery waste residues from the distiller Chivas Brothers for co-digestion. The largely homogenous waste significantly increased biogas production without impacting digestate quality, resulting in a win-win scenario for both parties.

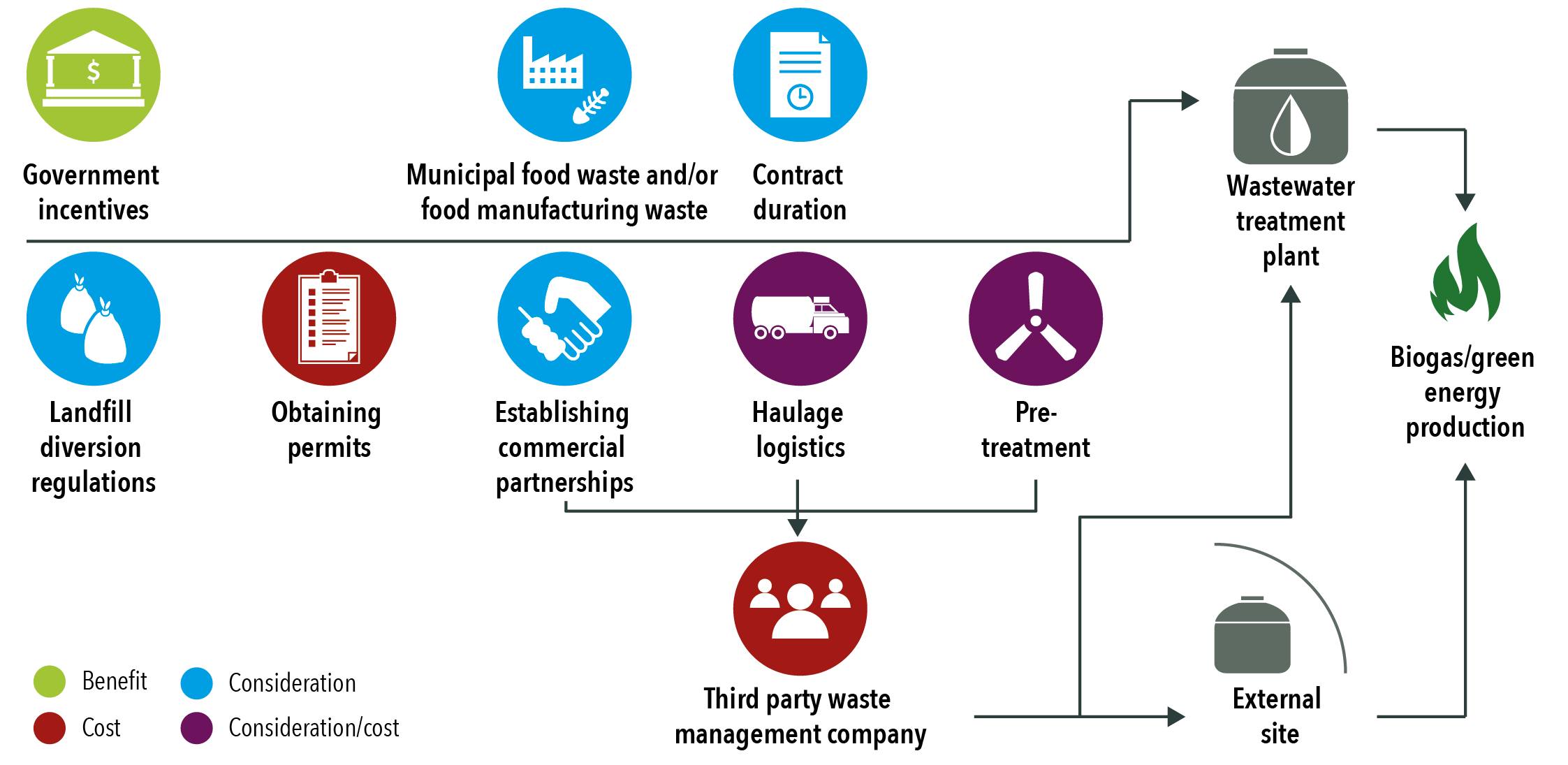

To minimise the burden on utilities, agreements are often made for non-homogenous waste producers to pre-process their feedstock prior to transport to the wastewater treatment plant. Alternatively, some utilities may outsource the entire process by setting up contracts with third party waste management companies that will haul sludge off-site and co-digest with food waste at a centralised anaerobic digestion facility.

Markets that welcome co-digestion are largely driven to do so by government policies. This includes permitting and regulatory support for co-digestion, governmental subsidies or financial incentives for biogas production, landfill diversion regulations, and organic waste collection policies – countries lacking some of these policies are likely to see less activity in this space.

Examples of markets already focusing on co-digestion include California (USA), Kobe (Japan), Singapore, and Sydney (Australia). In California, for example, the 2020 approval of Senate Bill 1383 stipulated a 75 per cent reduction of organic waste disposal in landfill by 2025, relative to 2014 levels. This organics diversion is estimated to result in 27 million tonnes of organic waste being diverted and thus requiring alternative disposal methods. Co-digestion addresses this while providing the added benefit of renewable energy generation.

Future markets may also emerge in the UK, Europe and South Africa due to recent landfill diversion legislation. The UK in particular has been working to open up a market for co-digestion by addressing existing barriers to the process. OFWAT, the economic regulator for water and sewerage companies in England and Wales, has highlighted co-digestion as a significant opportunity in the coming years, driven by waste management reform that requires all domestic and commercial food waste to be separately collected as of this year – increasing the availability of feedstocks.

Additionally, the Environment Agency’s Sludge Strategy will scrap the separate regulatory regime for sewage sludge residuals from late 2023, simplifying the regulatory environment for co-digestion by bringing sludge regulation under the Environment Permitting Regulation (EPR).

Despite these steps to open up the market, significant barriers still exist in the UK. Obtaining permits for the use of digestate from co-digestion is significantly more costly and challenging than from separate feedstocks. Additionally, mixed feedstocks’ ineligibility for many subsidies, including the Green Gas Support Scheme, further limits the economic appeal of co-digestion and adds to the many considerations involved in its implementation. The graphic below outlines such considerations and the logistics that precede the eventual adoption of co-digestion.

Source: GWI

Despite the potential challenges involved in implementing co-digestion, many facilities have been able to successfully implement the system to achieve greater progress towards net zero. One such success story can be seen in the Victor Valley Resource Recovery Centre in California. This facility, commissioned in 2022, is North America’s largest privately financed co-digestion-to-pipeline project converting 235,000 tons of food scraps and sludge into 320,000 MMBtu of renewable gas each year.

This project – designed, built, operated and financed by Anaergia through its subsidiary SoCal Biomethane – allows Victor Valley Wastewater Reclamation Authority to actualise circular economy principles by taking on California’s organic waste disposal challenge and leveraging it to become a net exporter of energy from biogas.

Alongside successful large scale co-digestion installations, innovation is opening up further opportunities for this market. The combination of co-digestion with thermal hydrolysis (THP) pretreatment is one such example: using THP increases digester capacity to allow more space for alternative feedstocks and also enables the greater breakdown of digestate to produce Class A biosolids. Installations already exist in Scandinavia and East Asia, while the combination has also been gaining traction in the USA where landfill disposal options are decreasing for both digestate and organic waste, driving interest in this as an alternative disposal route.

One consideration, however, is its potential to decrease biogas yield from some feedstocks such as food waste by 10-15 per cent in a worst-case scenario due to the production of melanoidins, which are non-biodegradable. It can be difficult to predict the exact impacts of THP due to the unclear makeup of sludge and food waste feedstocks.

Nonetheless, the benefit of having a greater offtake market for digestate that meets high land spreading standards may make co-digestion more practical and appealing for utilities. Innovations like these, therefore, can help to support utilities looking to cut GHG emissions and instead produce a useful, renewable biogas product.